|

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

Valmas Associates services include Greek Real Estate Law, Property Construction & Acquisitions, Property Management services and Golden Visa permanent residency applications. Contact us for our rates & services. The Greek parliament has ratified a set of amendments to the Golden Visa program, in an attempt to strike a balance between strengthening the real estate investment landscape and addressing the residential needs of residents in Greece. The core changes to the law are summarised as follows: Increase of Minimum Investment Thresholds - Two Zones of Investment €400k/€800k: A. For Attica region, Thessaloniki, Mykonos, Santorini, and islands with a population over 3,100, the minimum property investment rises to €800,000. This means that several Greek islands (unaffected by the previous increases in thresholds) will now have investment thresholds increased from 250k to 800k. These islands include: * Aegina * Alonissos * Andros * Chios * Corfu * Crete * Evia * Ikaria * Kalymnos * Karpathos * Kefalonia * Kos * Kythera * Lefkada * Leros * Lemnos/Limnos * Lesvos/Mytilene * Milos * Naxos * Paros * Patmos * Poros * Rhodes * Salamina * Samos * Skiathos * Skopelos * Spetses * Syros * Thassos * Tinos * Zante/Zakynthos Please note that on some of these islands, a border application is also necessary, i.e. a permit to purchase in border areas. B. For other areas, the minimum investment is set at €400,000. The investment must be in one property of a minimum surface of 120 sq.m., and cannot be made on multiple properties of lesser value. Exceptional application of the €250k threshold (with no limitations on location or surface of the property):

Use Restrictions: Rental and Usage Regulations: Investors can rent out their properties but cannot: a.offer them for short-term leases (e.g. Airbnb); or b. use them as business premises. Penalties: As regards applicable penalties, the following will apply:

Alternative Investments: Long-term leases or timeshare agreements for tourist accommodations also qualify for residency, with investment thresholds matching those for direct property purchases (€800,000 in specified regions, €400,000 in the rest of the country). Transitional Period: • Third-country nationals who either pay the full price, or make a 10% down payment and sign a preliminary notarial agreement or private purchase contract, proving such transactions by August 31, 2024, can complete their investment by December 31, 2024, under the conditions that existed before the ratification of the new amended law. If the property purchase is not finalised, the buyer may switch to another property under the aforementioned old conditions but not beyond April 30, 2025. The transitional period is designed so that it ensures a smooth implementation of the new law. It offers an opportunity for investors who are already in the process of acquiring property or are considering moving ahead, with effect to finalising their investments under the prior legal conditions.

0 Comments

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

Valmas Associates services include Greek Real Estate Law, Property Construction & Acquisitions, Property Management services and Golden Visa permanent residency applications. Contact us for our rates & services. The Greek Golden Visa Law (permanent residency by real estate investment e.g. via acquisition of property in Greece) has been amended. The minimum investment threshold on purchases of property to the end of receiving a Greek permanent residency permit (renewable every five years) has changed in several areas of Greece. More specifically, the minimum investment threshold has increased on several areas, whereas the number of properties to be acquired has been limited to one in these areas. The core changes to the above can be summarised as follows: 1. Purchases of real estate in the central, north and south section of Athens as well as in Thessaloniki, Mykonos and Santorini are subject to the amendments in the law namely: a. Investment threshold is established at 500,000 EUR and b. Investment should be in one property only. 2. Purchases of real estate in the rest of Athens’ eastern and western suburbs as well as the remainder of Greece, will be falling under the thresholds of 250,000 EUR, whereas the threshold amount (250,000 EUR) could be met by purchasing one or more properties i.e. there are no restrictions as in the areas described under 1. above. Taking advantage of the current legal regime It is also specified that, had investors required to take advantage of the current legal regime, where thresholds are at 250,000 EUR all over Greece (including Mykonos, Santorini, Athens centre etc.) with no limitations to one property, they should transfer 10% of the transactional value to the sellers by the 30th of April 2023 (through a private or notarial agreement) whereas the final conveyancing agreement and respective bank transfers of the remainder of the agreed sum, should take place by (no later than) the 31st of December 2023. So for example, an investment in two properties in the centre of Athens valued at 150,000 EUR each, will still be possible as long as a. a deposit of 10% is paid to the sellers by April, 30th 2023 (extended until July 31st, 2023) and b. the final conveyancing agreement is signed by the 31st of December 2023. Valmas Associates services include Greek Real Estate Law, Property Construction & Acquisitions, Property Management services and more.

With respect to real estate investments in Greece, we can provide the following services:

We are pleased to announce that IFLR1000 The guide to the world’s leading financial and corporate law firms have recognized the work of Valmas Associates.

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

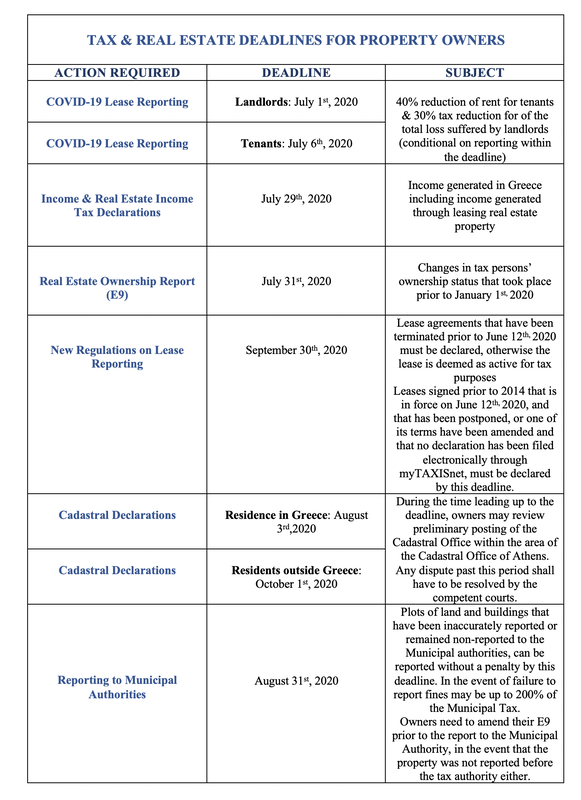

The following form the upcoming deadlines for real estate owners and tenants of properties for the remainder of 2020. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The International Chamber of Commerce (ICC) published an updated form of clauses with a view to helping large and small businesses when drafting contracts so that they cover and provide for unforeseen events such as the COVID-19 outbreak. It is attached below. For more info on force majeure clauses see our post > published the 23rd of February. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The 6th Legislative Act of the Greek Government, containing Measures on Mitigating the Spread of COVID-19, has been published today. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The 5th Legislative Act of the Greek Government has been published today. Our analysis shall follow. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The Greek Government announced a forth set of actions through a newsletter that will be followed by a Legislative Act (the 5th since the COVID-19 crisis started). Some of the main contents of the newsletter are the following: All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

A new Legislative Act was published on the 20th of March 2020 aiming among others to mitigate the spread of COVID-19, Support and Financially Assist private persons and businesses as well as ensure that the Greek market remains functional. Some of the measures contained in 72 Articles and the subsequent Ministerial and Joint Ministerial Decisions include: All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

On the 14th of March 2020, the Greek government has brought into effect -among others - the following measures: Valmas Associates are committed to providing customers with world-class services. During the outbreak of COVID-19, we have devised a business continuity plan that abides to domestic and international regulations while proactively ensuring protection of public health. Subject to the limitations set out by the above, we will be available for consultation, day-to-day work and support to our clients during these challenging times. As a result we are available on our mobile numbers, landline numbers and through email, thus remaining fully operational.

We firmly believe that by being responsible to each other and united, we can get through this situation soon. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

In this newsletter we deal with the implications for GDPR following the outbreak of COVID-19 in relation to: a. employers when balancing between confidentiality of infected individuals (employees) and public interest (informing others who have been put at risk); b. employees while working remotely. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

Article 285 of the Greek Penal Code contains a provision termed Violation of measures to prevent epidemics. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The new Legislative Act by the Greek government which coincided with the declaration of the COVID-19 disease as a pandemic by the World Health Organization (WHO), was published on the 11th of March 2020 and consists of 22 Articles. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

On the 19th of February 2020, the European Commission presented its strategies for Data and Artificial Intelligence envisioning a digital transformation that will work for all within the EU and will promote the values of openness, fairness, diversity, democracy and confidence according to its claims. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The outbreak of COVID-19 at the end of 2019 has undoubtedly impacted global trade and has created concerns for the year ahead. The aviation sector has largely been affected as a result, since it is also the main method of transport via which the virus has spread. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

In this newsletter we outline the stages of a real estate transaction in Greece. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

As of December 2019, Greece rolled out a tax reform (Law 4646/2019), aiming - among others - to attract High Net Worth Individuals (HNWIs) to relocate their tax domicile to Greece and opt for being subjected to an attractive tax regime for the income they generate outside Greece. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

On the 25th of February, the Greek Government passed (and published on the Government Gazette) a Legislative Act termed "Urgent Measures for Avoidance and Restriction of Spreading Coronavirus (COVID-19)". The measures contained in the 5 Articles of the Legislative Act may be imposed and had they come into effect, they should further be defined by Ministerial Decisions of the competent Ministries. We are thrilled to announce that panelists and judges on IFLR1000 The guide to the world’s leading financial and corporate law firms have listed Valmas Associates with the esteemed ranking institution.

IFLR is the market-leading financial law publication for lawyers in financial institutions, corporates and private practice. IFLR was first published in 1982. IFLR1000 is the guide to the world's leading financial and corporate law firms and lawyers covering the business of law in over 120 jurisdictions worldwide. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

This article examines the possible implications and viability of claiming force majeure in the light of disruptions to global trade that the recent COVID-19 outbreak has caused. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

EU countries lost €137 billion in Value-Added Tax (VAT) revenues in 2017 according to a study released by the European Commission in September 2019. The loss in VAT revenue has prompted some critical actions by the European Commission and initiated some changes to the EU VAT rules and accounting processes. The major changes, under EU VAT legislation, do not take effect until 2022 or later, but there are some immediate steps that the EU implemented that took effect on Jan. 1, 2020. These are referred to collectively as the Quick Fixes, and will impact businesses engaged in cross border trade involving the movement of goods. There are four Quick Fixes that have taken effect and as of Jan. 1, 2020 businesses should have been taking action accordingly, so that they remain in compliance. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication. LAW 4646/2019: REFORMS IN REGARD TO THE HELLENIC INCOME TAX CODE Article 2: Alternative taxing to income received abroad for natural persons (HNWIs) that move their tax residence to Greece A taxpayer who moves her/his tax residence to Greece can be subjected to an alternative method of taxation for income received abroad if both of the following conditions are met:

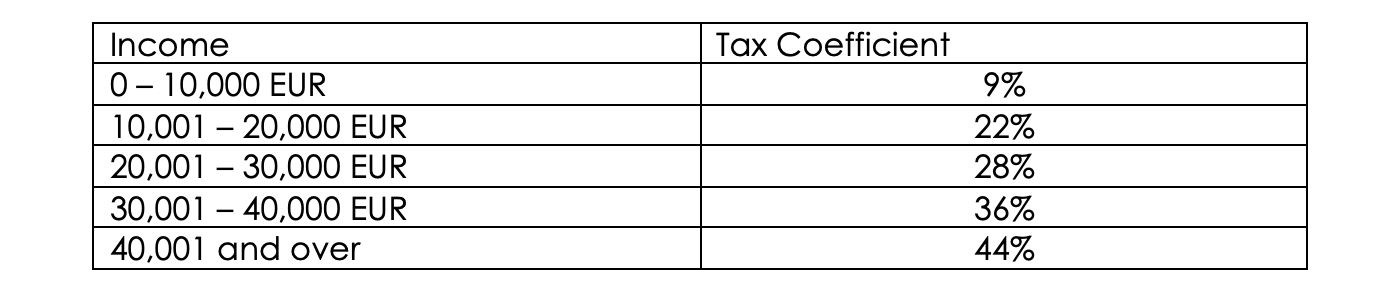

Had the application been accepted, the person shall pay a fixed tax of 100,000 EUR per year regardless of the income generated abroad. This person has an option to request the extension of the above provision to relatives. In that case an amount equal to 20,000 EUR per relative should be paid per year. Assets located outside Greece are exempt from the Greek inheritance or gift tax. The funds imported in Greece are not required to be justified. Income generated abroad is not reported. The maximum duration of the program is 15 years. Application procedure outline: • Filing of an application by 31 March of the relevant tax year; • Approval of the application by the Greek tax authorities within 2 months from filing; • Notification of the foreign tax authorities regarding the transfer of the applicant’s tax residence in Greece; • Payment of the annual tax within 30 days from the date of the application approval. Article 6: Amendment of Article 15 of the Income Tax Code in regard to tax rates for wages, pensions, business activity of persons. Example: A worker declares income of 12,000 EUR per year. He/she will be taxed with 9% for the amount of 10,000 EUR and 22% for the remaining 2,000 EUR.

Article 11: Corporate Social Responsibility (CSR) Deductible Expenses Expenses related to CSR activities are now classified as expenses made in the interest of the company and within its ordinary course of business. CSR expenses are tax deductible under the condition that the company has accounting profits in the tax year in which the expenses are made. Article 12: Deductions Related to Employees and the Protection of the Environment 130% deduction has been enacted for expenses made from 01/01/2020 onward, for the following expenses made for: · purchase of monthly or annual season tickets for public transportation; · leasing of company cars of zero or low emission up to 50gCO2/Km, with Retail Price Before Taxes (RPBT) up to 40,000 EUR; · purchase, installation and operation of publicly accessible charging points for electric vehicles of zero or low emission up to 50gCO2/Km. Article 16: Deduction of tax for service-related expenses made toward the energy related, operational and aesthetic upgrade of buildings. 40% of the expenses incurred from services performed within the context of the energy, functional/operational and aesthetic upgrade of buildings will reduce individuals’ income tax and shall be distributed in four equal parts for the four following years. The maximum amount of deductible expenses can be 16,000 EUR. The above tax rebate is granted to private individuals subject to special requirements and shall apply for expenses (services only) incurred during calendar years 2020-2022. Such expenses must be paid by electronic means of payment. Article 22: Reduction of Corporate Income Tax (CIT) The nominal corporate income tax (CIT) rate is reduced to 24% (formerly 28%) for fiscal years 2019 onward. Article 24: Reduction of Dividend Withholding Tax Dividend withholding tax is reduced to 5% (formerly 10%) as of 01/01/2020. Article 26: Corporate Income Tax Prepayment CIT prepayment which was assessed upon the filing of the CIT return for fiscal year 2018 is reduced to 95% (formerly 100%). Article 28: Betterment Tax for Sellers Further Suspension Betterment Tax for Sellers: Pursuant to Article 41 of Law 4172/2013, a betterment tax on the transfer of real estate, will be imposed on the seller of real estate property in Greece with a coefficient of 15 percent calculated upon the profit the seller made by the sale of the property when compared to the original purchase value of the property. There are reduction factors limiting the amount of tax a seller will be called to pay upon the profits from the resale of his/her property based on amount of time they kept ownership and other factors. In the event a property has not been purchased and e.g. has been inherited or gifted, then the acquisition price will be based on the tax originally paid when one inherited or was gifted the property. The betterment tax has been further postponed until the 31st of December 2022. Article 29: Digital platforms (e.g. Airbnb) obligations to disclose information to the Hellenic Independent Authority of Public Revenues (ΑΑΔΕ). Disclosure obligations are introduced for administrators of any digital platform active in the sharing economy, within specified deadlines and with penalties provided for non-compliance for both the platform and third parties involved (Network Service Providers and users of the platform for the provision of services). Maximum penalties come up to 100,000 EUR for non-compliance of Network Service Providers and to 5,000 EUR to “sellers” on the above platforms, to the requests of the Hellenic Independent Authority of Public Revenues (ΑΑΔΕ). Article 39: Amendment of the VAT Code in regard to Suspension of VAT on Property Transfers. For the period 2020-2022, the sale of properties by constructors/developers of buildings (that would normally be subject to 24% VAT) will be exempt from VAT. Following an application of a property developer/construction company offering properties for sale, there is a compulsory suspension of VAT until 31/12/2022. The suspension will be applied to the total number of unsold properties of the developer. The application should be filed no later than 6 months from the coming into effect of Law 4646/2019 (for already issued permits) whereas for new building permits the application should be filed within 6 months of the issuing of the building permit. Thus, the exemption covers both buildings which have been completed (built) with building permits following 01/01/2006, as well as those that will be built within the aforementioned three-year period. Article 51: Amendments in respect to tax values of zones and properties In order to determine the tax values of properties that are transferred for any reason (sale, parental gift etc.) prices will now be affected by coefficients such as construction quality, age, position on the building block, floor, location on a central spot or lack thereof, tourist value in respect to agricultural plots etc. New committees will be assigned this task. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication.

The below newsletter is an interpretation & analysis of the announcements made by Greece's Prime Minister in relation to - among others - reforms on property transfer taxes & construction activities in Greece. These were made during a gala event organized by The Economist in Athens Greece on October 23rd. 2019 CURRENT PROPERTY TRANSFER TAX REGIME: Pursuant to current Greek tax law, a 24% VAT is imposed on the first acquisition of apartments and properties for which the building permit was issued after the 1st of January 2006. All other properties are exempt from VAT and a 3.09% property transfer tax is imposed on the buyer. PROPOSED BILL'S PARTICULARS: 1. The Greek Government plans to pass a new law soon, suspending VAT for 3 years on unsold brand new properties from developers for which the building permit was issued after January 1st 2006 and - at least - until the lapse of the 3 year suspension. 2. In an effort to further boost the real estate market in Greece, the government shall further suspend VAT on properties not yet completed for which building permits where acquired from 1/1/2006 as well as on newly or to-be-acquired building permits within this period of suspension. This way, the government aims to jump-start building activities. The details of the above bill have not been fully disclosed yet. 3. According to the announcement from the Prime Minister (during The Economist's gala event), the suspension of VAT shall also affect property owners who acquired apartments under the antiparochi (αντιπαροχή) system. Antiparochi (αντιπαροχή) is a sui generis Greek arrangement, whereby the owner of a plot of property is compensated with apartments in lieu of payment for the land that he relinquished to the developer who built an apartment block on the plot. We will keep you posted when the final bill has been implemented in national legislation. HOW WILL BRAND NEW PROPERTIES BE TAXED IF VAT IS SUSPENDED: The most probable scenario is that sales of the above properties will be taxed with 3,09% property transfer tax, (that is imposed on buyers of second hand properties) instead of the current 24%. EXAMPLE: In practice if a buyer acquired a brand new apartment at 200,000 EUR today, he/she would be called upon to pay 48,000 EUR on VAT. When the new law comes into effect, in most circumstances, they will be called upon to pay just a little over 6,000 EUR for a property purchase value of 200,000 EUR which is what second hand property buyers pay. The saving in the above example is 42,000 EUR. OTHER ANNOUNCEMENTS: Betterment Tax for Sellers Pursuant to Article 41 of Law 4172/2013, a betterment tax on the transfer of real estate, will be imposed on the seller of real estate property in Greece with a coefficient of 15 percent calculated upon the profit the seller made by the sale of the property when compared to the original purchase value of the property. This law's coming into force is going to be suspended for a further 3 years. The government has also announced that it will examine the abolition or amendment of this law at the lapse of the suspension period. Deduction of Income Tax for Works/Renovations Carried out on Properties towards their Aesthetic & Environmental Upgrade This is a proposed law that is still being debated. |

for Special Editions & Publications see our Publications >

About our Newsletters |

Valmas Associates are committed to providing clients with regular updates on legislative and industry changes in the form of opinions, publications and newsletters. The content on our website does not constitute legal advice.

About the Author |

Ioannis Valmas LLB, LLM, (MSc) is Managing Partner at Valmas Associates and a Greek lawyer licensed by the Athens Bar since 2008. His writings on Greek Real Estate Law have been widely published in recent years by publishers in Greece and abroad.

Blog Archives |

April 2024

|

Leaders in Greek Real Estate Law & Greek Golden Visa.

|

Legal |

Languages

|

|

© 2024 Valmas Associates | Greek Law Firm, Greek Lawyers

|

|