|

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication. LAW 4646/2019: REFORMS IN REGARD TO THE HELLENIC INCOME TAX CODE Article 2: Alternative taxing to income received abroad for natural persons (HNWIs) that move their tax residence to Greece A taxpayer who moves her/his tax residence to Greece can be subjected to an alternative method of taxation for income received abroad if both of the following conditions are met:

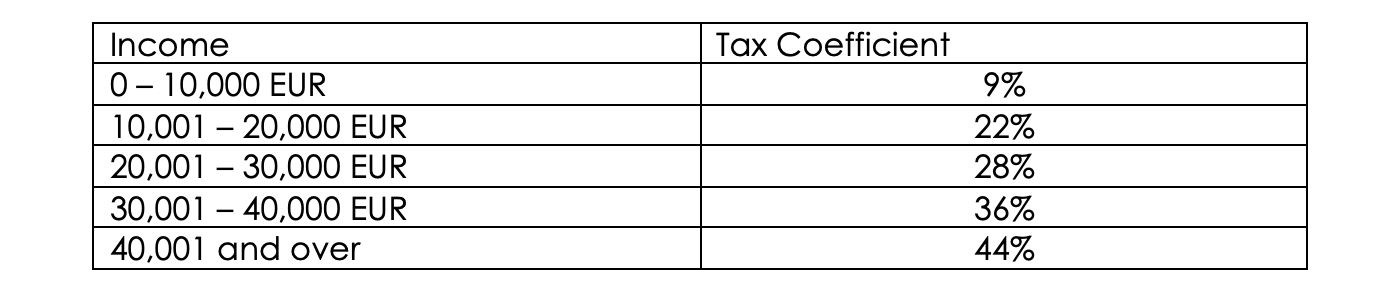

Had the application been accepted, the person shall pay a fixed tax of 100,000 EUR per year regardless of the income generated abroad. This person has an option to request the extension of the above provision to relatives. In that case an amount equal to 20,000 EUR per relative should be paid per year. Assets located outside Greece are exempt from the Greek inheritance or gift tax. The funds imported in Greece are not required to be justified. Income generated abroad is not reported. The maximum duration of the program is 15 years. Application procedure outline: • Filing of an application by 31 March of the relevant tax year; • Approval of the application by the Greek tax authorities within 2 months from filing; • Notification of the foreign tax authorities regarding the transfer of the applicant’s tax residence in Greece; • Payment of the annual tax within 30 days from the date of the application approval. Article 6: Amendment of Article 15 of the Income Tax Code in regard to tax rates for wages, pensions, business activity of persons. Example: A worker declares income of 12,000 EUR per year. He/she will be taxed with 9% for the amount of 10,000 EUR and 22% for the remaining 2,000 EUR.

Article 11: Corporate Social Responsibility (CSR) Deductible Expenses Expenses related to CSR activities are now classified as expenses made in the interest of the company and within its ordinary course of business. CSR expenses are tax deductible under the condition that the company has accounting profits in the tax year in which the expenses are made. Article 12: Deductions Related to Employees and the Protection of the Environment 130% deduction has been enacted for expenses made from 01/01/2020 onward, for the following expenses made for: · purchase of monthly or annual season tickets for public transportation; · leasing of company cars of zero or low emission up to 50gCO2/Km, with Retail Price Before Taxes (RPBT) up to 40,000 EUR; · purchase, installation and operation of publicly accessible charging points for electric vehicles of zero or low emission up to 50gCO2/Km. Article 16: Deduction of tax for service-related expenses made toward the energy related, operational and aesthetic upgrade of buildings. 40% of the expenses incurred from services performed within the context of the energy, functional/operational and aesthetic upgrade of buildings will reduce individuals’ income tax and shall be distributed in four equal parts for the four following years. The maximum amount of deductible expenses can be 16,000 EUR. The above tax rebate is granted to private individuals subject to special requirements and shall apply for expenses (services only) incurred during calendar years 2020-2022. Such expenses must be paid by electronic means of payment. Article 22: Reduction of Corporate Income Tax (CIT) The nominal corporate income tax (CIT) rate is reduced to 24% (formerly 28%) for fiscal years 2019 onward. Article 24: Reduction of Dividend Withholding Tax Dividend withholding tax is reduced to 5% (formerly 10%) as of 01/01/2020. Article 26: Corporate Income Tax Prepayment CIT prepayment which was assessed upon the filing of the CIT return for fiscal year 2018 is reduced to 95% (formerly 100%). Article 28: Betterment Tax for Sellers Further Suspension Betterment Tax for Sellers: Pursuant to Article 41 of Law 4172/2013, a betterment tax on the transfer of real estate, will be imposed on the seller of real estate property in Greece with a coefficient of 15 percent calculated upon the profit the seller made by the sale of the property when compared to the original purchase value of the property. There are reduction factors limiting the amount of tax a seller will be called to pay upon the profits from the resale of his/her property based on amount of time they kept ownership and other factors. In the event a property has not been purchased and e.g. has been inherited or gifted, then the acquisition price will be based on the tax originally paid when one inherited or was gifted the property. The betterment tax has been further postponed until the 31st of December 2022. Article 29: Digital platforms (e.g. Airbnb) obligations to disclose information to the Hellenic Independent Authority of Public Revenues (ΑΑΔΕ). Disclosure obligations are introduced for administrators of any digital platform active in the sharing economy, within specified deadlines and with penalties provided for non-compliance for both the platform and third parties involved (Network Service Providers and users of the platform for the provision of services). Maximum penalties come up to 100,000 EUR for non-compliance of Network Service Providers and to 5,000 EUR to “sellers” on the above platforms, to the requests of the Hellenic Independent Authority of Public Revenues (ΑΑΔΕ). Article 39: Amendment of the VAT Code in regard to Suspension of VAT on Property Transfers. For the period 2020-2022, the sale of properties by constructors/developers of buildings (that would normally be subject to 24% VAT) will be exempt from VAT. Following an application of a property developer/construction company offering properties for sale, there is a compulsory suspension of VAT until 31/12/2022. The suspension will be applied to the total number of unsold properties of the developer. The application should be filed no later than 6 months from the coming into effect of Law 4646/2019 (for already issued permits) whereas for new building permits the application should be filed within 6 months of the issuing of the building permit. Thus, the exemption covers both buildings which have been completed (built) with building permits following 01/01/2006, as well as those that will be built within the aforementioned three-year period. Article 51: Amendments in respect to tax values of zones and properties In order to determine the tax values of properties that are transferred for any reason (sale, parental gift etc.) prices will now be affected by coefficients such as construction quality, age, position on the building block, floor, location on a central spot or lack thereof, tourist value in respect to agricultural plots etc. New committees will be assigned this task.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

for Special Editions & Publications see our Publications >

About our Newsletters |

Valmas Associates are committed to providing clients with regular updates on legislative and industry changes in the form of opinions, publications and newsletters. The content on our website does not constitute legal advice.

About the Author |

Ioannis Valmas LLB, LLM, (MSc) is Managing Partner at Valmas Associates and a Greek lawyer licensed by the Athens Bar since 2008. His writings on Greek Real Estate Law have been widely published in recent years by publishers in Greece and abroad.

Blog Archives |

April 2024

|

Leaders in Greek Real Estate Law & Greek Golden Visa.

|

Legal |

Languages

|

|

© 2024 Valmas Associates | Greek Law Firm, Greek Lawyers

|

|