All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, or stored in any retrieval system of any nature without prior permission of the publisher. Application for permission for other use of copyright material including permission to reproduce extracts in other published works shall be made to the publisher. Full acknowledgment of author, publisher and source must be given. Nothing in this newsletter shall be construed as legal advice. Professional advice should therefore be sought before any action is undertaken based on this publication. The work on Greek property law below was published in November 2018 by Ioannis Valmas, managing partner at Valmas Associates and is part of ICLG’s Guide to Real Estate 2019. Some information contained therein may be or may become out of date. 1 Real Estate Law 1.1 Please briefly describe the main laws that govern real estate in your jurisdiction. Laws relating to leases of business premises should be listed in response to question 10.1. Those relating to zoning and environmental should be listed in response to question 12.1. Those relating to tax should be listed in response to questions in Section 9. The principal law governing Real Estate matters in Greece is The Law of Rights in Rem (Law of Real Property – Εμπράγματο Δίκαιο) in Chapter 3 of the Hellenic Civil Code, under Articles 947–1345. Specific real estate matters are also dealt with in the Hellenic Code of Civil Procedure, other parts of the Hellenic Civil Code, the Hellenic Constitution and by statutory law. 1.2 What is the impact (if any) on real estate of local common law in your jurisdiction? The Hellenic Republic, Greece is a civil law country thus, real estate matters are regulated largely by the Hellenic Civil Code, the Hellenic Code of Civil Procedure, the Constitution and statutory law. However, judicial precedent, jurisprudence (a common law legal system’s principal feature) is quintessential as laws – in many instances – leave a wide scope for interpretation; thus, judicial precedent, is frequently cited by lawyers and judges, and ultimately taken into consideration by courts of law in Greece, particularly the judicial precedent set by the Court of Cassation (Άρειος Πάγος) and Council of State (Συμβούλιο της Επικρατείας). 1.3 Are international laws relevant to real estate in your jurisdiction? Please ignore EU legislation enacted locally in EU countries. By virtue of rules of Private International Law, incorporated in national legislation (Article 4 et seq. Hellenic Civil Code), the principle of lex rei sitae applies to real estate property in Greece (Article 27 of the Hellenic Civil Code). The domicile of a claimant or defendant is thus irrelevant. The courts of the vicinity where the property is located are thus the competent courts. 2 Ownership 2.1 Are there legal restrictions on ownership of real estate by particular classes of persons (e.g. non-resident persons)? Below are several of the categories of limitations on the acquisition/ ownership of real estate in Greece by non-residents of third countries: Articles 25 par. 1 and 26 par. 2 of Law 1892/1990, as amended by Article 114 Law 3978/2011, define that the acquisition of real estate in regions of Greek territory designated as border areas, is permitted to individuals and legal entities which are Greek or have their citizenship or place of business within a Member States of the European Union and the European Free Trade Association without any limitations. Third countries’ nationals may enjoy the same tight conditions upon prior authorisation by the Hellenic (Greek) State. These persons should apply to a special committee to obtain permission before acquiring or renting the real estate as well as before proceeding to any shareholders’ structure change. Accordingly, they shall have to submit an application to the regional Decentralised Administration Authority’s Committee of Article 26 Law 1892/1990 prior to acquisition of the property. These Committees are set up in regional border zone areas including Preveza, Thesprotia, Florina, Kastoria, Kilkis, Xanthi, Rodopi, Evros, Mytilene (Lesvos), islands of the Dodecanese, Thera (Santorini), Skyros, areas of Drama and Ioannina, Serres, etc. 3 Real Estate Rights 3.1 What are the types of rights over land recognised in your jurisdiction? Are any of them purely contractual between the parties? Rights over Land/Rights in Rem: (a) ownership (full, bare & usufruct, Article 999 of the Hellenic Civil Code); (b) easement rights (by virtue of Article 1118 of the Hellenic Civil Code); (c) mortgage (burden, encumbrance, Article 1257 of the Hellenic Civil Code) over real estate as security in favour of creditors of the owner; and (d) “surface right”, as defined by Article 18 et seq. Law 3986/2011, conferring a right to use real property owned by the Hellenic State, Public Law Entities and State Agencies, for a period of time ranging between five and 99 years. Apart from the above, various purely contractual rights can be acquired over land (e.g. lease agreement, use free of charge agreement – “loan for use” (χρησιδάνειο) agreement, etc.). 3.2 Are there any scenarios where the right to land diverges from the right to a building constructed thereon? One such example is the case of the surface right of Article 19 Law 3986/2011 where the right to building on State-owned properties is conferred to a third party. 3.3 Is there a split between legal title and beneficial title in your jurisdiction and what are the registration consequences of any split? Are there any proposals to change this? There is no such split under the laws of the Hellenic Republic, Greece. 4 System of Registration 4.1 Is all land in your jurisdiction required to be registered? What land (or rights) are unregistered? It is mandatory to register all rights in rem over real property in Greece to the operating competent Registrars: 1. Land Registry; and/or 2. Hellenic Cadastre. Registration with the one or the other depends on whether the latter has been implemented in the area a property is located. Land Registry – System of Transcriptions and Mortgages Books: Currently applies to the majority of the territory of the Hellenic Republic, Greece. Rights in rem are subject to registration therein. Hellenic Cadastre (formerly known as National Cadastre): Where the Cadastral System has been implemented, rights in rem are recorded in the competent local Cadastral office. Each plot is granted a registration number and individual/independent properties within the plot are assigned with a number under the plot’s registration number. Contractual rights such as lease agreements are not registrable with the exception of long-term, non-commercial notarial lease agreements that exceed the length of nine years. The only exception of unregistered right is the case of adverse possession where a party possesses over a specified period of time a property (10 or 20 years depending on whether the possession of the disseisor is in good or bad faith). Once this period lapses, formal recognition of such a property right may be obtained via a court decision and Registration of the title (court decision in this case) may subsequently commence. 4.2 Is there a state guarantee of title? What does it guarantee? There is no State Guarantee of title under the laws of the Hellenic Republic, Greece. 4.3 What rights in land are compulsory registrable? What (if any) is the consequence of non-registration? As indicated in question 4.1 above, it is mandatory to register all rights in rem over real property in Greece to the competent Land Registry and/or Cadastral Office; in essence these are the rights acquired/transferred through a formal procedure/notarial deed (for example, notarial purchase agreements, property donations such as parental donations, court decisions pronouncing ownership rights or other rights in rem over assets, partitioning agreements, acceptance of inheritance deeds, court decisions pronouncing the acquisition of ownership rights through extraordinary adverse possession, rural expropriation decisions, implementation acts of the town plan, etc.). Registration with the competent Land Registry and/or Cadastral Office is a prerequisite for the completion of a real estate transaction (i.e., the transfer of ownership or other in rem rights). Consequently, lack of registration equals to non-transfer of ownership or to better say not creating a right in rem of e.g. the buyer or not terminating a right in rem of e.g. the seller over real estate. A non-commercial lease over real estate for a duration exceeding nine (9) years is only valid to a subsequent new owner of such real estate if the lease has been drawn up in the form of a notarial deed and has been registered with the competent Land Registry and/or Cadastral Office. Such registration is not compulsory, but provides the tenant with the above protection against a subsequent owner. 4.4 What rights in land are not required to be registered? As indicated in questions 4.1 and 4.3 above, contractual rights such as business or housing lease agreements are not registrable with the exception of long-term, non-commercial notarial lease agreements exceeding the length of nine years. Also, Expropriations declared for public interest do not have to be registered with either the Land Registry or the Hellenic Cadastre; accordingly, with effect from the date of payment of the compensation amount to the former owner of the expropriated property, ownership rights are transferred to the entity (public or private) that is the beneficiary of the expropriation. On the other hand, rural and zoning expropriations must be registered with the competent Registrar. 4.5 Where there are both unregistered and registered land or rights is there a probationary period following first registration or are there perhaps different classes or qualities of title on first registration? Please give details. First registration means the occasion upon which unregistered land or rights are first registered in the registries. According to the system pertaining to Land Registries there is no probationary period after the first registration for ownership rights; registration becomes effective when it occurs. In regards to the Hellenic Cadastre corrections of initial registrations/ non-registrations of rights should be made within seven to 14 years (the latter only with regards to areas that the Cadastre was implemented before the coming into force of Law 3481/2006). 4.6 On a land sale, when is title (or ownership) transferred to the buyer? Ownership is transferred to the buyer via the Notarial Deed/ Purchase Agreement and the subsequent registration of the title (Notarial Deed) to the competent Land Registry or Cadastral Office. 4.7 Please briefly describe how some rights obtain priority over other rights. Do earlier rights defeat later rights? In respect to Mortgages, in the event where multiple mortgages are registered on the same property, the principle of priority awards preferential satisfaction to the rights of the creditor (mortgagee) whose right was registered. In the less common event mortgages had been registered on the same day, the creditors will be proportionally satisfied. 5 The Registry / Registries 5.1 How many land registries operate in your jurisdiction? If more than one please specify their differing rules and requirements. As indicated in various sections above, there are two types of authorities/registrars for real estate in Greece: 1. the System of Transcriptions and Mortgages Books – Land Registry; and 2. the Hellenic Cadastre (formerly known as the National Cadastre). With the full deployment/implementation of the Hellenic Cadastre in the future, remaining Land Registries will no longer register property rights and will be replaced by the Hellenic Cadastre. 5.2 How do the owners of registered real estate prove their title? An owner or a potential buyer can apply to the competent Registrar on the Land Registry for a Certificate of Ownership; a similar certificate may be acquired from the competent office of the Hellenic Cadastre. Lawyers’ due diligence may also reveal the ownership status of a property. 5.3 Can any transaction relating to registered real estate be completed electronically? What documents need to be provided to the land registry for the registration of ownership right? Can information on ownership of registered real estate be accessed electronically? A registration cannot be completed electronically. Registering a transaction will have to be completed with submission to the Land Registry of the notarial deed, a summary of the deed, an application for registration, tax declaration and the payment of the registration fee. A similar process is required for registration with the Cadastral Office. Information can be accessed through visits to the competent Land Registry Office or Cadastral Office and it is available electronically (on all Cadastral Offices) or through a manual search of hard copies of records (some Land Registries may not have info available electronically). 5.4 Can compensation be claimed from the registry/ registries if it/they make a mistake? The law specifies that the Registrars of the Land Registries are liable for compensation exclusively for any acts or omissions related to the fulfilment their duties. The Cadastral Authority may be liable on any occasion that a party suffers damages as a result of the operation of the Hellenic Cadastre. 5.5 Are there restrictions on public access to the register? Can a buyer obtain all the information he might reasonably need regarding encumbrances and other rights affecting real estate and is this achieved by a search of the register? If not, what additional information/process is required? Both the Land Registry and the Hellenic Cadastre are obliged by statute to make copies of the Transcription & Mortgages Books (Land Registry) or Cadastral Records (Hellenic Cadastre) available to the public. A manual search on the records and due diligence of the titles, however, may only commence via hiring a lawyer. 6 Real Estate Market 6.1 Which parties (in addition to the buyer and seller and the buyer’s finance provider) would normally be involved in a real estate transaction in your jurisdiction? Please briefly describe their roles and/or duties. Parties with a vital role in a real estate transaction in Greece are as follows: 1. Lawyers: The execution of the notarial deed, due diligence on titles, coordination of the sale process are some of the quintessential parts of the transaction that a lawyer may provide assistance with. Although not compulsory, representation by a lawyer is vital, especially for the buyer of real estate in Greece. 2. Notaries: The notary executes the notarial deed and checks – along with the lawyer – the validity of certificates provided by the seller as well as their conformity with the law. 3. Realtors/Agents: Although it is not compulsory to appoint one, a realtor is often utilised by buyers and sellers of real property. 4. Civil Engineers: Civil Engineers are usually appointed by sellers and provide topographic drawings, declarations of conformity of the property with the law, certificates on non-existence of illegal constructions/buildings, energy environmental certificates that are prerequisites for the completion of a transfer via a notarial deed. 5. Accountants: Accountants are vital for making annual tax statements (including statement for property ownership) and – if any – income from real estate property. A distinct category of bodies involved in the process is the tax office where transfer tax is paid by the buyer (currently at 3.09 per cent of the value of the transaction (tax or actual, whichever is the highest), and Registrars (Land Registry or Hellenic Cadastre (fees at around 0.6–0.8 per cent of the value of the transaction) where the property is subsequently registered. 6.2 How and on what basis are these persons remunerated? With the exception of notaries’ fees, fees of professionals are subject to an agreement between the parties. Notarial fees are calculated as a percentage of the value of the transaction (actual or tax value (whichever is higher)) plus by the pages and copies of the deed. 6.3 Is there any change in the sources or the availability of capital to finance real estate transactions in your jurisdiction, whether equity or debt? What are the main sources of capital you see active in your market? There has been a considerable increase in the availability of capital in the past 2–3 years, largely in the form of foreign equity. In parallel, there is an increase in investment inflows due to the participation of foreign funds in the share capital of Real Estate Investment Companies and individual investors buying properties in rural centres and tourist areas. 6.4 What is the appetite for investors and/or developers to invest in your region compared to last year and what are the sectors/areas of most interest? Please give examples. Greece’s real estate market has been demonstrating clear signs of recovery since 2017 and urban centres have been at the epicentre of real estate investments from investors from all over the world. Local prices are still well below pre-crisis levels making Greece an undisputed buyer’s market. According to the Bank of Greece, in Q1/2017, Athens property was 44 per cent cheaper than its 2008 peak. Sales of tourist residences, apartments in the urban centres and properties over the value of 250,000 EUR (the latter attracting Golden Visa applicants) seem to dominate real estate transactions. Properties on the Greek islands seem to do considerably well also. Finally, many private investors from countries such as Israel seem to prefer low value/older properties for investment, by subsequently renovating and leasing on short-term leases (e.g. AirBnB) or longer term leases (e.g. annual or two-year leases to students or permanent residents). Furthermore, following the implementation of the new legislation on Non-Performing Loans and the commencement of enforcement and auction proceedings from banks, there has been noted an interest in such properties also. 6.5 Have you observed any trends in particular market sub sectors slowing down in your jurisdiction in terms of their attractiveness to investors/developers? Please give examples. House building has remained slow in Greece during the years of the financial crisis, but there are signs of recovery, and there has been forecasted an increase in new constructions within 2018. 7 Liabilities of Buyers and Sellers in Real Estate Transactions 7.1 What (if any) are the minimum formalities for the sale and purchase of real estate? The minimum prerequisites for the transfer of ownership of real estate are: (a) signing the purchase agreement (notarial deed) by the contracting parties; (b) payment of the agreed price; (c) payment of the transfer tax; and (d) registration of such deed with the competent Land Registry/Cadastre. Also, according to Law 4495/2017, all real estate property transaction deeds are mandatorily accompanied with a legally binding statement from the owner, and a certificate from the engineer declaring and certifying that no illegal structures or uses exist. Breach of any of these conditions results in invalidity of the notarial deed and entails severe sentences against all parties involved in the transactions. After the entry into force of Laws 4174/2013 and 4223/2013, as in force, any in rem or contractual agreement, by virtue of which rights over real property are established, transferred, altered or a mortgage or pre-notation of mortgage right is granted thereon, is null and void, if no ENFIA (Uniform Tax on the Ownership of Immovable Property) certificate is attached to the notarial deed, verifying that the real property has been properly declared and the tax obligations for a period of five years prior to the transaction have been fulfilled. 7.2 Is the seller under a duty of disclosure? What matters must be disclosed? Unlike with several common law jurisdictions, sale of real estate is not caveat emptor in Greece. The seller is under a duty of disclosure (please see question 7.5 below). 7.3 Can the seller be liable to the buyer for misrepresentation? A seller can be liable on both civil and criminal grounds leading to a series of consequences for him/her such as: annulment of the contract; reduction of the sale price; compensation for the buyer; and criminal liability/imprisonment. 7.4 Do sellers usually give any form of title “guarantee” or contractual warranties to the buyer? What would be the scope of these? What is the function of any such guarantee or warranties (e.g. to apportion risk, to give information)? Would any such guarantee or warranties act as a substitute for the buyer carrying out his own diligence? As part of the due diligence process, the buyer should require deeds evidencing ownership of the property from the seller, issued by the competent Land Registry and a full series of ownership titles of the seller’s predecessors covering at least a 20-year period prior to the most recent ownership title. Also the lawyer of the seller should conduct a deep search on the records as part of the due diligence process whereas release of advance payments as part of any promissory agreement should be made until due diligence has been conducted. Furthermore, the seller formally states and signs in the notarial deed that he guarantees and warrants that the property is free from any: encumbrance; mortgage; debt; pre-notation of mortgage; confiscation; claims by third parties; real and legal defects; leases; concession of use by any means; expropriation; contribution of land; and any debts to public authorities. These guarantees and warranties can be deemed as a substitute for the buyer’s lack of due diligence although the above processes are costly, take a long time and have risks, so it is advisable that due diligence is conducted through the lawyer of the buyer prior to signing the notarial deeds and the subsequent transfer of property. 7.5 Does the seller retain any liabilities in respect of the property post sale? Please give details. Please see question 7.4 above. 7.6 What (if any) are the liabilities of the buyer (in addition to paying the sale price)? The buyer pays for the notary fee, the transfer tax, registration fees with the competent authority as well as realtor, lawyer fees, etc. 8 Finance and Banking 8.1 Please briefly describe any regulations concerning the lending of money to finance real estate. Are the rules different as between resident and non-resident persons and/or between individual persons and corporate entities? No custom regulations for lending exist and residents/non-residents as well as individuals/corporate entities do not enjoy more privileges over one another. 8.2 What are the main methods by which a real estate lender seeks to protect itself from default by the borrower? Usually a lender will be protected with a mortgage or a prenotation of a mortgage over the property with its subsequent registration with the competent Registrar (Land Registry or Cadastral Office). 8.3 What are the common proceedings for realisation of mortgaged properties? Are there any options for a mortgagee to realise a mortgaged property without involving court proceedings or the contribution of the mortgagor? The realisation of mortgaged properties can only be effected through enforcement by public auction. The mortgagee cannot automatically acquire ownership rights over the mortgaged property. 8.4 What minimum formalities are required for real estate lending? The lender shall require proof that the borrower is the owner of the property and shall establish a mortgage over the property prior to enumeration of the mortgagee. 8.5 How is a real estate lender protected from claims against the borrower or the real estate asset by other creditors? As mentioned in question 4.7, the principle prior in tempore prior in jure shall have effect in mortgages so it would make sense for a lender to establish a first-rank mortgage before any other burden. Article 1272 of the Hellenic Civil Code provides that the rank is defined by the date of the first Registration of the Mortgage. 8.6 Under what circumstances can security taken by a lender be avoided or rendered unenforceable? As an example, a court order can render a security unenforceable in the event, e.g., that it was granted to defraud third creditors and a third creditor seeks, e.g., an injunction from the competent court rendering it unenforceable. 8.7 What actions, if any, can a borrower take to frustrate enforcement action by a lender? The new Hellenic Civil Procedure Code which came into force in 2016 limited the capabilities of a borrower against enforcement actions by lender(s) (Articles 933 & 934). Interim measures (filing a caveat) may be sought against the auction process (for limited reasons) with a right of the borrower to appeal against the decision (Article 937). 8.8 What is the impact of an insolvency process or a corporate rehabilitation process on the position of a real estate lender? As noted in questions 4.7 and 8.5, the principle of prior in tempore prior in jure shall, in principle, have effect on Mortgages existing prior to the declaration of the insolvency (the lender being considered as a secured creditor) and subject to the requirements/limitations of the Greek Insolvency Code – Law 3588/2007 as amended (see, for example, Articles 21, 26, etc.). 8.9 What is the process for enforcing security over shares? Does a lender have a right to appropriate shares in a borrower given as collateral? If so, can shares be appropriated when a borrower is in administration or has entered another insolvency or reorganisation procedure? According to Article 26 para. 1 of the Greek Insolvency Code secured creditors can enforce security exclusively over the asset (e.g. property burdened with a Mortgage in their favour). They can only be remunerated from the whole of the insolvent estate if they resign from the privilege of the security on the asset (e.g. mortgage) or in the event the privilege/security is not enough for their full remuneration. 9 Tax 9.1 Are transfers of real estate subject to a transfer tax? How much? Who is liable? The buyer bears the obligation to enumerate the local Tax Office with the transfer tax at a rate of 3.09 per cent of the tax or actual value (whichever is the highest) or VAT on the first sale of newly built buildings (see question 9.4 below). 9.2 When is the transfer tax paid? Transfer tax should be paid prior to the signing of the notarial deed and a certificate/receipt should be presented before the notary, attached to the deed and be referenced on it. 9.3 Are transfers of real estate by individuals subject to income tax? Betterment Tax for Sellers: Pursuant to Article 41 Law 4172/2013, a betterment tax on the transfer of real estate, will be imposed on the seller of real estate property in Greece with a coefficient of 15 per cent calculated upon the profit the seller made by the sale of the property when compared to the original purchase value of the property. There are reduction factors limiting the amount of tax a seller will be called to pay upon the profits from the resale of his/ her property based on amount of time they kept ownership and other factors defined by the above law. The coming into effect of the above provision has continued to be postponed since its inception and subsequent enactment and it has now further been suspended until the 31st December 2018. 9.4 Are transfers of real estate subject to VAT? How much? Who is liable? Are there any exemptions? VAT (24%) is imposed on the purchase value on the first sale of newly built buildings by a developer, or by a person who deals professionally with the construction and the sale of buildings. For all other properties that do not fall under the above category, the transfer is charged with a real estate transfer tax at 3.09 per cent. 9.5 What other tax or taxes (if any) are payable by the seller on the disposal of a property? No further taxes, other the ones outlined in the sections above, burden the buyer. 9.6 Is taxation different if ownership of a company (or other entity) owning real estate is transferred? Transfer tax is the same for companies and private individuals. Revenue made from a transfer may be subject to further or differing (between individuals or companies) taxation. 9.7 Are there any tax issues that a buyer of real estate should always take into consideration/conduct due diligence on? Tax issues have been outlined above, although depending on the end purpose of the acquisition (business, residence) the buyer should be advised accordingly. 10 Leases of Business Premises 10.1 Please briefly describe the main laws that regulate leases of business premises. The principal laws regulating leases of business premises are the Hellenic Civil Code and Presidential Decree 34/1995 as amended by Laws 3853/2010, 4242/2014 and 4373/2016. 10.2 What types of business lease exist? Several types of business leases exist such as: 1. Business Leases pertaining to certain business activities such as banking operations, marine trade/shipping, agents, etc. 2. State/Public leases pertaining to housing public authorities. 3. Leases pertaining to certain professions such as lawyers, language schools, doctors, accountants, notaries, civil engineers, process servers, etc. 10.3 What are the typical provisions for leases of business premises in your jurisdiction regarding: (a) length of term; (b) rent increases; (c) tenant’s right to sell or sub-lease; (d) insurance; (e) (i) change of control of the tenant; and (ii) transfer of lease as a result of a corporate restructuring (e.g. merger); and (f) repairs? A. Length of term Business Leases after the coming into force of Law 4242/2014 are for a three-year minimum term, even in case a lesser term has been agreed upon in writing with a lease agreement. Lengthier terms are allowed. B. Rent increases Adjustments may be claimed by the landlord in the absence of an explicit agreement. If a dispute arises, Regional Committees for the Settlement & Re-Adjustment of Rent have been set up under the auspices of Article 15 Law 4013/2011. Resorting to the Committee is conditioned on the ground that a two-year period since the business lease started (or since the last downward adjustment of rent) has lapsed. C. Tenant’s right to sell or sub-lease Selling is not permitted by the tenant, whereas sub-letting according to Article 593 of the Hellenic Civil Code is not prohibited unless there was an agreement to the contrary between the landlord and tenant. D. Insurance It is not compulsory to insure the business premises but it does make sense for either the landlord or tenant to do so (for different reasons each). E.i. Change of control of the tenant The change of control does not have any effect unless otherwise stated in the business lease agreement. E.ii Transfer of lease as a result of corporate restructuring In principle, there will be no consequences on the lease agreement as the new participants will succeed the previous ones by default. In the event of bankruptcy of the landlord and auction of the property, the highest bidder is entitled to evict the tenant within two months according to the Hellenic Civil Procedure Code. F. Repairs The property must be fit for its intended purpose and use, although the agreement may contain clauses to the contrary. 10.4 What taxes are payable on rent either by the landlord or tenant of a business lease? Every natural person/individual that owns property in Greece is entitled to lease their property and generate income, so long as they declare the profits/income to the tax authorities. No residence permit is required for this type of activity as it is not a business activity per se. Furthermore, a solidarity levy at a coefficient of 2.2 per cent up to 10 per cent (depending on the total income) is imposed if the annual income exceeds 12,000 EUR.

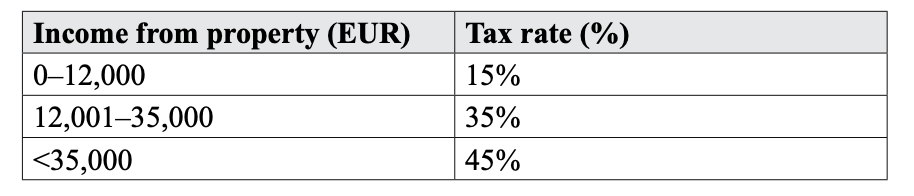

Net taxable real estate income of individuals is subject to rules, according to which not all expenses (including depreciation) are necessarily taken into account Net taxable income of legal entities is treated as income from a business operation and the related expenses are tax deductible if the general preconditions set by law are met and if they are inscribed in the books of the company and evidenced by documentation. 10.5 In what circumstances are business leases usually terminated (e.g. at expiry, on default, by either party etc.)? Are there any special provisions allowing a tenant to extend or renew the lease or for either party to be compensated by the other for any reason on termination? As a general rule, leases can be terminated at the expiry of their set contractual term or for any of the reasons stipulated in the agreement nd the law (non-payment, etc.). A lease is implicitly active/ renewed for an indefinite length if the tenant continues to enumerate the landlord and the landlord receives the rent enumeration after the date of termination and can subsequently be terminated pursuant to the Hellenic Civil Code. The law sets out provisions and scenarios for compensation of both the landlord and tenant in the event the relationship is terminated early. 10.6 Does the landlord and/or the tenant of a business lease cease to be liable for their respective obligations under the lease once they have sold their interest? Can they be responsible after the sale in respect of pre-sale non-compliance? The tenant shall be fully liable once they have sold their interest while the agreement is still in force; the landlord will be succeeded in his rights and obligations by the new owner, although he may be liable to the latter for pre-sale non-compliance. 10.7 Green leases seek to impose obligations on landlords and tenants designed to promote greater sustainable use of buildings and in the reduction of the “environmental footprint” of a building. Please briefly describe any “green obligations” commonly found in leases stating whether these are clearly defined, enforceable legal obligations or something not amounting to enforceable legal obligations (for example aspirational objectives). According to Law 4122/2013, a Building Energy Performance Certificate is required for the conclusion tenancy agreement for an apartment, building, etc. (i.e. residential or business). Since the coming into force of Law 4245/2015, where it became compulsory for all leases to be filed electronically with the tax office, the details of the Certificate must be submitted on the platform of the tax office for any new lease filed falling under the scope of Law 4122/2013; the certificate’s validity can be automatically verified by the system. 10.8 Are there any trends in your market towards more flexible space for occupiers, such as shared short-term working spaces (co-working) or shared residential spaces with greater levels of facilities/ activities for residents (co-living)? If so please provide examples/details. With the advent of AirBnB and the ever increasing flows of tourists in Greece – urban centres in particular – short-term rental of properties has been awash with apartments offering sharing facilities (where, e.g., owner hosts a visitor in his/her own property, sharing facilities with them). 11 Leases of Residential Premises 11.1 Please briefly describe the main laws that regulate leases of residential premises. Leases of residential premises are regulated by the Hellenic Civil Code (Article 574 ) as well as Law 1703/1987 as amended by Law 2235/1984. 11.2 Do the laws differ if the premises are intended for multiple different residential occupiers? The law applies to multiple occupiers under the same tenancy agreement. 11.3 What would typical provisions for a lease of residential premises be in your jurisdiction regarding: (a) length of term; (b) rent increases/controls; (c) the tenant’s rights to remain in the premises at the end of the term; and (d) the tenant’s contribution/obligation to the property “costs” e.g. insurance and repair? A. Length of term Residential Tenancies are for a three-year minimum term, even in case a lesser term has been agreed upon in writing with a lease agreement. Lengthier terms are allowed. B. Rent increases/controls Please see question 10.3 above. C. Tenant’s rights to remain in the premises at the end of term At the lapse of the tenancy’s term, the tenancy becomes indefinite and it can remain until one of the parties provides a termination notice. D. Tenant’s contributions to property costs The tenant is to assume payments of communal expenses, bills of electricity, water, etc. Insurance is not compulsory for either landlord or tenant whereas repairs (unless damage is caused by the tenant) are to be assumed by the landlord. 11.4 Would there be rights for a landlord to terminate a residential lease and what steps would be needed to achieve vacant possession if the circumstances existed for the right to be exercised? Non-compliance with the terms of the tenancy agreement may result in an eviction process. The fastest method of eviction is via the process pursuant to Law 4055/2012. 12 Public Law Permits and Obligations 12.1 What are the main laws which govern zoning/ permitting and related matters concerning the use, development and occupation of land? Please briefly describe them and include environmental laws. Below we list the main regulatory instruments. Urban and Land-Use Planning Laws:

· Mostly EU Legislation implemented and incorporated into National Law. · The Hellenic Constitution sets out the boundaries as to construction activities primarily in Article 24. · A further limitation is imposed by Law 2971/2001 in respect to the protection of the coast and shoreline. 12.2 Can the state force land owners to sell land to it? If so please briefly describe including price/ compensation mechanism. The Hellenic Republic can expropriate real estate against full and prompt compensation to the owners or in rem beneficiaries, conditioned on the ground that by doing so such expropriation serves the public interest and that such legal route is provided by law. Pursuant to the Code of Expropriations of Immovable Property (Law 2882/2001) the expropriation process is considered to be officially declared by publication in the Government Gazette of notification by the expropriating party that payment of the lawful consideration in favour of the parties, whose property is being expropriated, has been made in a special account with the Deposits and Loans Fund. Unless full payment is made, the beneficiary of the expropriation cannot take possession of the expropriated asset. It is also possible that the expropriation may involve an exchange of properties (i.e. exchange the expropriated property with another property in possession of the expropriating party). The State assesses, among others, the value of the expropriation which is subject to judicial review by the Court of First Instance, which may either accept it or fix a new price. If the owner of the real estate objects to such price, he/she may file an appeal against the decision of the Court of First Instance. 12.3 Which bodies control land/building use and/or occupation and environmental regulation? How do buyers obtain reliable information on these matters? The responsible bodies for land-use building-use and occupation are the Technical Services Sectors of the Municipalities, the Environmental Departments of the Prefectures, the Town/City Planning Authorities, the Forest Registries and several Departments of the Ministry of Environment, Energy and Climate Change (ΥΠΕΚΑ). 12.4 What main permits or licences are required for building works and/or the use of real estate? Pursuant to Law 4495/2017, the below can be considered the main types of permits: 1. Common licence/permit. 2. Small-scale works permit for works under 25,000 EUR (described in Article 29 par. 2 Law 4495/2017). 3. Administrative pre-approval of the right to a building permit (for buildings over 3,000 sq.m. or when the permit is issued by another authority such as the Church’s Building Authority). 12.5 Are building/use permits and licences commonly obtained in your jurisdiction? Can implied permission be obtained in any way (e.g. by long use)? Building permits are commonly obtained by the competent local/ municipal authority. No implied permit can be obtained. 12.6 What is the typical cost of building/use permits and the time involved in obtaining them? The costs should include engineers’ reports/studies and supervision (which are freely negotiated with their clients) and should be heavily dependent on the type/complexity/size of building work undertaken as well as the area/locality of the competent authority. Since a complete file will have to be filed with the authority, timelines for obtaining permits will depend upon several factors. 12.7 Are there any regulations on the protection of historic monuments in your jurisdiction? If any, when and how are they likely to affect the transfer of rights in real estate or development/change of use? Article 24 of the Hellenic Constitution as well as Laws 3028/2002 and 4067/2012 – among other Laws – grant protection to monuments, antiquities, etc. of Greek heritage, including monuments from 1830 and buildings, constructions of historical heritage as young as 100 years old. 12.8 How can e.g. a potential buyer obtain reliable information on contamination and pollution of real estate? Is there a public register of contaminated land in your jurisdiction? There is no public register of contaminated sites in Greece other than decentralised inventories. Buyers will have to conduct their own due diligence. 12.9 In what circumstances (if any) is environmental clean- up ever mandatory? Pursuant to Article 28 Law 1650/1986, anyone who pollutes or damages the environment shall be liable on criminal grounds as well as – under Article 29 – for compensation whereas under Article 30 par. 2 interim administrative measures may be taken against a polluting business or polluting activity until suitable measures against the pollution are taken by the business. 12.10 Please briefly outline any regulatory requirements for the assessment and management of the energy performance of buildings in your jurisdiction. As mentioned in question 10.7, Law 4122/2013 sets out the requirements for the assessment and management of the energy performance of buildings. The inspector may provide guidance as to how to enhance the overall performance of the building and inspections should be made and certificates issued every 10 years. 13 Climate Change 13.1 Please briefly explain the nature and extent of any regulatory measures for reducing carbon dioxide emissions (including any mandatory emissions trading scheme). In June 2012, the registry architecture of the EU Emissions Trading System underwent a fundamental change. The Union Registry has replaced the EU Member States’ national registries. EU ETS operations were centralised in a single EU registry developed, operated and maintained by the European Commission. The Greek Greenhouse Gas Registry is part of the Union Registry. The Union Registry is an online database that holds accounts for stationary installations as well as for aircraft operators. It ensures accurate accounting for all allowances issued under the EU emissions trading system (EU ETS), precise tracking of holdings, issuances, transfers, cancellations and retirements of general allowances and Kyoto units. Therefore, all companies registered in the Greek Registry can perform all the necessary actions (e.g. transactions, surrendering), in this way. In line with EU legislation, the Greek part of the Union Registry is managed by the Section for Market Mechanism and Registry of Greenhouse Gas Emissions/Directorate of Climate Change and Air Quality of the Ministry of Environment and Energy which also serves as a contact point for national and international authorities. The Section for Market Mechanism and Registry of Greenhouse Gas Emissions is also responsible for the operational management of the registry and provides account holders with the required information and support. 13.2 Are there any national greenhouse gas emissions reduction targets? Greece has implemented a programme since 2000 which coordinates activities from the public & private sectors with the aim of limiting greenhouse gases. This programme has taken measures affecting the household and tertiary sectors, transportation, industry, electricity generation, waste disposal, agriculture, manufacturing processes and more. This aims to reduce emissions as part of a concerted EU effort to aggressively reduce emissions. 13.3 Are there any other regulatory measures (not already mentioned) which aim to improve the sustainability of both newly constructed and existing buildings? Ministerial Decision 171563/131 of 2018 creates incentives to homeowners to install new windows, heating systems, shading systems, etc. by subsidising the purchases with the programme Saving at Home. The programme is co-funded by the EU. Also the Rooftop PV Programme incentivises homeowners to install small photo-voltaic systems up to 10kWp on the rooftops of their buildings and selling the electricity produced to HEDNO (Hellenic Electricity Distribution Network Operator S.A.).

1 Comment

David Levi

10/12/2019 14:22:42

Great resource of information on real estate law. Thanks for sharing and elaborating on many issues i was looking info about. I will be following your articles closely. Keep up the good work.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

for Special Editions & Publications see our Publications >

About our Newsletters |

Valmas Associates are committed to providing clients with regular updates on legislative and industry changes in the form of opinions, publications and newsletters. The content on our website does not constitute legal advice.

About the Author |

Ioannis Valmas LLB, LLM, (MSc) is Managing Partner at Valmas Associates and a Greek lawyer licensed by the Athens Bar since 2008. His writings on Greek Real Estate Law have been widely published in recent years by publishers in Greece and abroad.

Blog Archives |

April 2024

|

Leaders in Greek Real Estate Law & Greek Golden Visa.

|

Legal |

Languages

|

|

© 2024 Valmas Associates | Greek Law Firm, Greek Lawyers

|

|